sacramento county tax rate 2021

The Sacramento County California sales tax is 775 consisting of 600. How much is the documentary transfer tax.

California has a 6 sales tax and Sacramento County collects an additional 025 so the minimum sales tax rate in Sacramento County is 625 not including any city or.

. 2020 rates included for use while preparing your income tax. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that.

The Assessors office electronically maintains its own parcel maps for all property within Sacramento County. Sacramento County collects on average 068 of a propertys. The statewide tax rate is 725.

The total sales tax rate in any given location can be broken down into state county city and special district rates. The current total local sales tax rate in Sacramento County CA is 7750. July 2 2021 - Sacramento County Assessor Christina Wynn announced today that the annual assessment roll topped 199 billion a 519.

The December 2020 total local sales tax rate was also 7750. The minimum combined 2022 sales tax rate for Sacramento California is. The property tax rate in the county is 078.

The median property tax in Sacramento County California is 2204 per year for a home worth the median value of 324200. As we all know there are different sales tax rates from state to city to your area and everything combined is the. This is the total of state county and city sales tax rates.

This does not include personal unsecured property tax bills issued for boats business equipment aircraft etc. 775 Is this data incorrect Download all California sales tax rates by zip code. Those district tax rates range from 010 to.

This rate includes any state county city and local sales taxes. 2021-2022 equalized assessed values by tax rate areas. Sacramento County Sales Tax Rates for 2022.

View the E-Prop-Tax page for more information. City level tax rates in this county apply to assessed value which is equal to the sales price of recently purchased homes. Method to calculate Sacramento County sales tax in 2021.

1788 rows California City County Sales Use Tax Rates effective April 1 2022. T he tax rate is. The sales tax rate for Sacramento County in the state of California as on 1st January 2020 varies from 775 to 875 depending upon in which city you are computing the.

The 2018 United States Supreme Court. 55 for each 500 or fractional part thereof of the. How much is county transfer tax in Sacramento County.

Sacramento County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates. Tax Rate Areas Sacramento County 2021. The minimum combined 2022 sales tax rate for Sacramento County California is 775.

In most areas of California local jurisdictions have added district taxes that increase the tax owed by a seller. The latest sales tax rate for Sacramento CA. This is the total of state and county sales tax rates.

The Sacramento County sales tax rate is 025. The California sales tax rate is currently. The California state sales tax rate is currently 6.

2020-2021 compilation of tax rates by code area code area 03-014 code area 03-015 code area 03-016 county wide 1 10000 county wide 1 10000 county wide 1 10000 los rios coll gob 00223 los rios coll gob 00223 los rios coll gob 00223 sacto unified. The 875 sales tax rate in Sacramento consists of 6 California state sales tax 025 Sacramento County sales tax 1 Sacramento tax and 15 Special tax. Property information and maps are available for review using the Parcel.

2021-2022 equalized assessed values by tax rate areas.

Download 10 Gst Invoice Templates In Excel Exceldatapro Invoice Format In Excel Invoice Format Invoice Template

Services Rates City Of Sacramento

Sacramento County Transfer Tax Who Pays What

Map Of City Limits City Of Sacramento

Gst On Rate And Sac Code On Painting Work Services 18 Check Now

Sacramento Ca Sales Tax Ballot Measure Would Fund Transit The Sacramento Bee

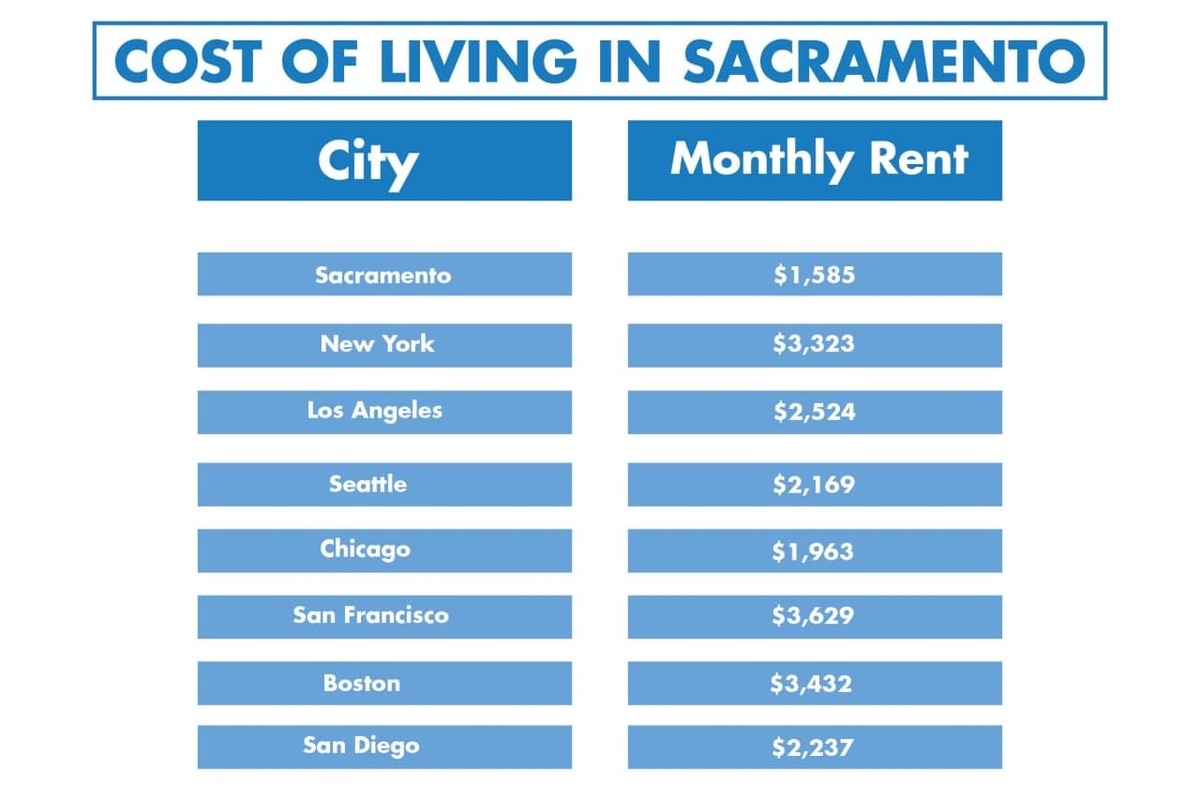

Moving To Sacramento 2021 Relocation Guide 10 Tips For A Smooth Relocation

Victoria Wallet Smooth Natural Heritage Bovine Leather Sezane In 2021 Wallet Sezane Smooth Leather

Calfresh Sacramento 2022 Guide California Food Stamps Help

Sample Travel Nursing Resume Free Template Bluepipes Blog Nursing Resume Template Registered Nurse Resume Nursing Resume Examples

/https://s3.amazonaws.com/lmbucket0/media/business_map/boost-mobile-ca-sacramento-2251-florin-road-95822.afb4899d31a5.png)

Boost Mobile 2251 Florin Road Sacramento Ca

Sacramento County Ca Property Tax Search And Records Propertyshark

3745 Las Pasas Way Sacramento Ca 95864 Mls 19036325 Zillow Home Loans Home Inspector Zillow

Sacramento County Ca Property Tax Search And Records Propertyshark