tax identity theft description quizlet

- Tax identity theft is the use of someone elses personal information to file a fraudulent tax return or claim tax benefits - Tax ID fraudsters file early because they have stolen personal information do they want to file with that information before the legitimate taxpayer files. The IRS has worked hard to help victims of identity theft by making improvements and shortening the time it takes to resolve these complex situations.

This is usually a method of gaining access to the persons resources like credit.

. A tax ID fraudster often part of a ring of scammers will file dozens or even hundreds of phony returns with other consumers personal. We know identity theft can be frustrating and confusing for victims. If you suspect you are a victim of identity theft continue to pay your taxes and file your tax return even if you must file a paper return.

The IRS in partnership with the state tax administrations and the software companies that produce at-home filing software has announced several changes. Tax return identity theft is the act of filing a return using a stolen identity and taking the victims refund. Tax-related identity theft happens when someone steals your personal information to commit tax fraud.

Criminal identity theft occurs when someone cited or arrested for a crime uses another persons name and identifying information resulting in. Learn vocabulary terms and more with flashcards games and other study tools. Tax identity theft occurs when someone steals your Social Security Number SSN and uses it to file a fraudulent return in your name in order to steal your refund assuming that youre entitled to one.

The IRS outlines its definition of tax identity theft as occurring when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund Basically its identity. To help law enforcement in investigating and prosecuting identity theft the Federal Trade Commission FTC maintains a national database of complaints by identity theft victims. This type of ID theft happens when fraudsters break into the secure systems of actual tax preparers and online tax preparing systems.

Tax identity theft is when a criminal steals your information specifically your Social Security number and uses it to file a fraudulent tax return. Equipped with three simple ingredients a name birthdate and Social Security number the thief can commit tax fraud resulting in delayed or stolen refunds. In the early days of.

Tax identity theft whether its with the Internal Revenue Service or your states Department of Revenue Franchise Tax Board or other Taxation agency can be a complicated issue to resolve. There are a lot of ways ones identity can be stolen. Tax-related identity theft occurs when someone uses your stolen Social Security Number to file a tax return claiming a fraudulent refund.

During tax season tax identity theft is one of the most common forms of identity theft. A form of identity theft in which someone steals the identity and sometimes even the role within society of a recently deceased individual. ID theft through a tax professional.

The personalityies that is created through a persons online interactions. The scam works like this. Identity theft is a crime under federal law and under the laws of more than 44 states that carries serious penalties including imprisonment and fines.

Criminals send these claims to the Internal Revenue Service IRS using stolen personal details such as your social security number SSN and name. Cyber identity may differ from a persons actual offline identity. These new measures are.

Tax Identity Theft This Identity Theft shows itself through fraudulent tax refund claims. More from HR Block. Since that time the definition of identity theft has been statutorily defined throughout both the UK.

Identity theft occurs when someone uses another persons personal identifying information like their name identifying number or credit card number without their permission to commit fraud or other crimesThe term identity theft was coined in 1964. Identity Theft study guide by Kolpigra000 includes 18 questions covering vocabulary terms and more. -hurting job prospects-increasing insurance rates-affect social security income credits-slow down tax refund-leave you with a criminal record-kill you virtually-get the wrong treatment at.

Identity theft is when a thief gains access to your personal information identity fraud describes a crime in which a thief creates a fictitious person. Start studying Identity Theft Test. Quizlet flashcards activities and games help you improve your grades.

Estimates are that this form of fraud costs consumers 52 billion each year. This is done so that the thief can claim the victims tax return for themselves. Tax ID theft was the biggest form of ID fraud reported to the Federal Trade Commission in 2014.

This route gives them access to much more information than just one single person making it a much larger tax-related fraud scheme. All identity theft is a crime under California law but criminal identity theft refers to one type of the crime. Tax-related identity theft occurs when someone uses your stolen personal information including your Social Security number to file a tax return claiming a fraudulent refund.

The fraudulent refund can be obtained via mail or direct. Tax identity theft is a large-scale problem in the United States due to an increase in cyber attacks on employers insurers payroll service providers universities and retailers. Your taxes can be affected if your Social Security number is used to file a fraudulent return or to claim a refund or credit.

And the United States as the theft of. When it comes to tax-related identity theft the Internal Revenue Service wants to resolve your case as quickly as possible. Identity theft is a kind of theft that involves someone stealing the identity of someone else by assuming that persons identity Lai Li Hsieh 2012.

Unlike some other forms of identity theft it can be hard to take preventative measures to avoid tax identity theft. Data Breach An incident in which sensitive protected or confidential records have potentially been viewed stolen or. The Equifax security breach alone exposed 143 million consumers with complete data on Social Security numbers names addresses birth dates and in some cases drivers license numbers.

Tax identity thieves steal taxpayers names and Taxpayer Identification Numbers like Social Security Numbers or Individual Taxpayer Identification Numbers for one of two reasons.

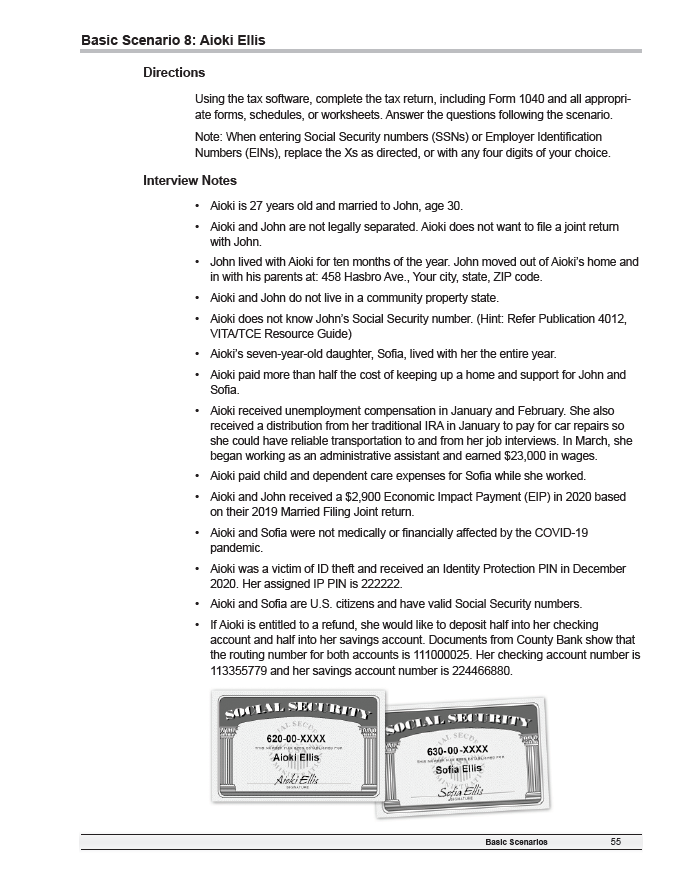

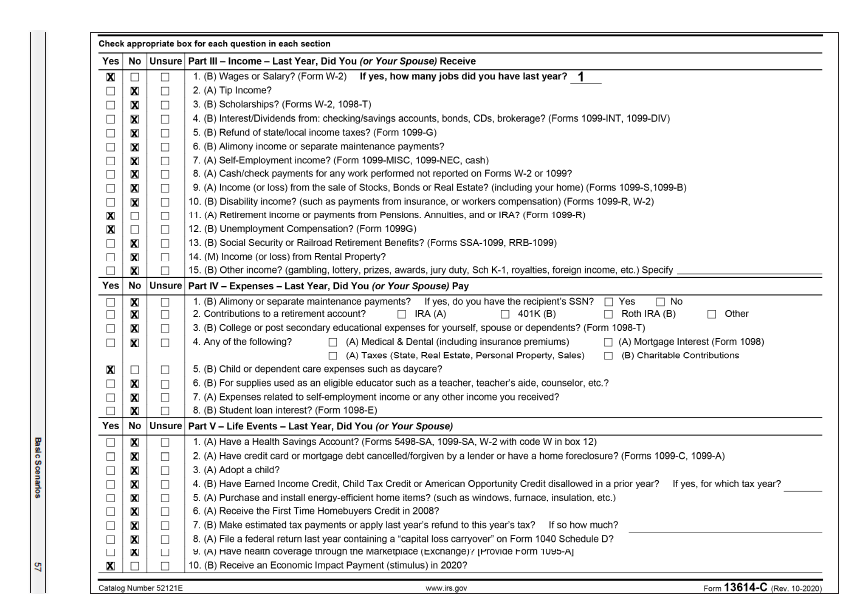

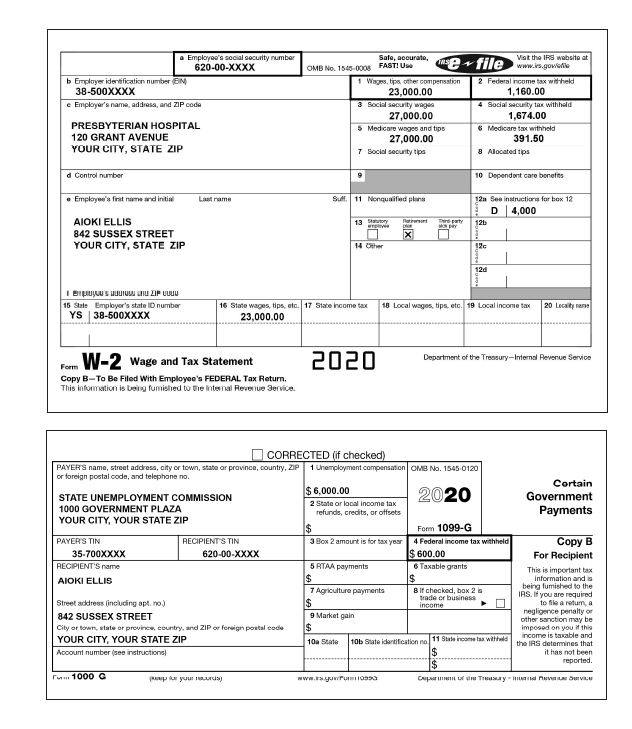

Solved 30 Aloki Can Use Her Ip Pin From Any Year To File Chegg Com

Difference Between Standard Deduction And Itemized Deduction H R Block

Identity Theft Insurance What Is It And What Does It Cover

Solved 30 Aloki Can Use Her Ip Pin From Any Year To File Chegg Com

Solved 30 Aloki Can Use Her Ip Pin From Any Year To File Chegg Com

Get Monthly Payday Loans Are The Great Aid For The Poor Creditor As They Get Rid Of Their Tension Of Fin Payday Loans Loans For Bad Credit Instant Payday Loans

Difference Between Standard Deduction And Itemized Deduction H R Block

Solved 30 Aloki Can Use Her Ip Pin From Any Year To File Chegg Com

Solved 30 Aloki Can Use Her Ip Pin From Any Year To File Chegg Com

Identity Theft What It Is What To Do Equifax

Your Guide To Prorated Taxes In A Real Estate Transaction

Identity Theft What It Is What To Do Equifax

Experts Think That Up To 35 Of Your Credit Rating Is Based On Your Paying Of Costs On Time So Thi Credit Repair Business Credit Repair Credit Repair Services

Solved 30 Aloki Can Use Her Ip Pin From Any Year To File Chegg Com